Soybean crushing volume is at an all-time high for the month of March in the United States. According to a report released this month by the National Association of Oilseed Processors (NOPA), the quantity is 4.95 million tonnes. However, the available grain stock was less than expected.

“Not because of the crushing numbers – which were already high and in line with expectations – but because of a drop in soybean oil inventories, far below estimates, of US exports, which had to gain much from the crop collapse in Brazil, may be limited”, it observes hEDGEpoint Global Markets Grain and Animal Protein Analyst Pedro Schicchi.

In an analysis published this week, experts show that crushing in China has declined sharply over the past month, as weak margins for the country’s pork producers are affecting the rest of the chain. In turn, this factor is causing the USDA to reduce its projection of soy imports by country.

The picture for crushes in the United States remains strong and Nopa has come with news of a boom in this regard. In fact, not the actual crushing figures, but soybean oil stocks in the country have declined.

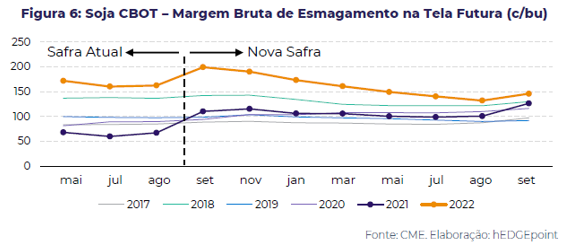

With oil still leading the crush margins — due to higher energy prices and projected mandates to grow biodiesel — higher inventories were not yet a factor of concern, but could have built up at one point or another. Due to the Argentine scenario, domestic consumption in the United States tends to be sustained throughout the year and, in particular, once new crop supplies arrive, as can be seen below:

The counterpoint, however, is that in terms of the current crop’s O&D, this month’s NOPA report is actually of little change, as the momentum so far indicates a close approximation of the USDA’s current readings on the US crush. Moreover, higher prices combined with the post-PSA outlook in China is putting pressure on crush margins in the country and leading to lower import readings across the country, which may start to offset some bullish sentiment for the US. Is.