Tesla went general public 10 decades back right now, pricing shares at $17, better than its anticipated array of $14 to $16.

The business raised around $226 million in its IPO, with shares surging that day by all around 41% to shut at $23.89. Right now, shares in the electric powered vehicle maker closed at $1,009.35, this means Tesla’s stock has risen by 4,125 % because the close of its to start with day as a public company.

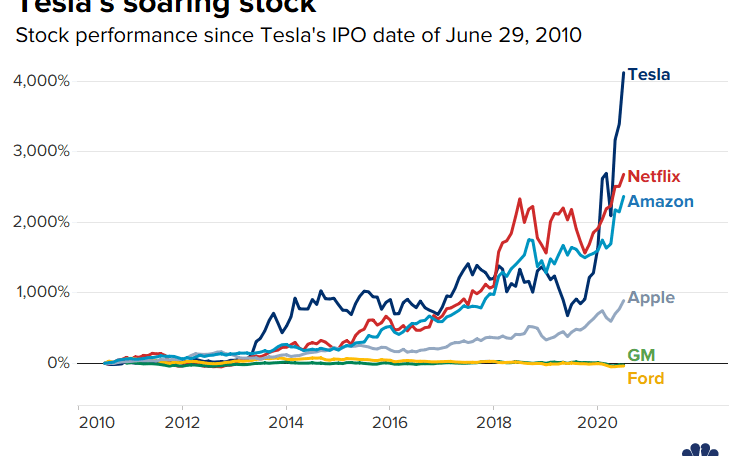

That stock overall performance places Tesla in rarified air, together with Netflix, which was the major-performing inventory on the S&P 500 during the 2010s. (Netflix rose 4,181% in between Jan. 2010 and Dec. 2019. But Netflix shares a lot more than doubled in cost concerning Jan. 2010 and June 2010, when Tesla went public. That signifies Netflix has “only” acquired 2,657% in value considering that Tesla’s debut.) It also implies Tesla stock has outperformed other massive tech names like Amazon and Apple, as effectively as all the big automakers.

The inventory has had a good deal of ups and downs together the way, which includes a 30% fall in the thirty day period following Aug. 7, 2018, when a CEO Elon Musk tweeted that he had “funding secured” to consider the business private. The SEC accused Musk of deceptive the general public, as he allegedly understood the funding was contingent, and both of those Musk separately and Tesla as a firm compensated $20 million fines to settle the match.

But shares have been on a rally considering the fact that early 2020, as Tesla acquired its manufacturing facility in Shanghai up and functioning and commenced production the Product Y at its unique U.S. car or truck plant in Fremont, California. Traders also bought into the firm’s promises to provide an electrical semi truck known as the Semi, electric powered pickup truck acknowledged as the Cybertruck and enhancements in self-driving technological innovation. Inspite of the Covid-19 epidemic, which shut down generation in its California manufacturing facility for a number of months, shares are up much more than 140% this year.

Because going community, Tesla has hardly ever reached a total year of profitability. The organization has reported seven quarters with web money larger than zero, because its IPO — the 1st was Q1 of 2013. It has now documented three consecutive quarters of GAAP income, with some accounting changes along the way, and is scheduled to report Q2 earnings next month.

Tesla is now gunning for inclusion in the S&P 500, which requires a least of four consecutive quarters of profitability, among other factors.