Mukesh Ambani’s strategy to make India ‘2G-mukt’ will hit the incumbent operators really hard, primarily Vodafone Concept specified its massive base of 2G subscribers.

Right after racking up 100 million buyers for its 4G-enabled aspect telephones (JioPhone), Reliance Jio in partnership with Google is eyeing the entry-stage smartphone segment. Jio is planning to earn around 350 million 2G function cellphone users by launching a smartphone ‘at a portion of the latest cost’.

Industry experts believe that that Jio, which dominates the cellular broadband room (4G) with 58% market share, could seize the incumbents’ industry share in the function mobile phone segment with its new supplying.

Even though Bharti Airtel has 135 million 2G buyers, 47% of its complete subscriber foundation of 283 million, Vodafone Strategy has 174 million 2G consumers, about 60% of its overall subscriber foundation of 291 million [calculated at the end of the March quarter].

Mayuresh Joshi, head of fairness research at William O’Neil India, stated “Vodafone Thought has the optimum 2G subscriber foundation amid the major a few operators. This coupled with a weak fiscal predicament and incapability to commit big capex investment will make it the most prone to subscriber decline. The ongoing churn for Vodafone could accelerate if Jio is in a position to start a smartphone at a considerably reduce cost in partnership with Google.”

In contrast to Bharti Airtel which has not too long ago amassed funds and is at ease on the web financial debt to operating profit metric, Vodafone Thought will uncover it complicated to protect its industry share owing to substantial leverage.

The company’s payouts going in advance incorporate modified gross revenue (AGR) dues as perfectly as deferred spectrum payments. Even with a deferred AGR payment, Motilal Oswal Economic Services estimate that the business would demand an operating income of Rs 30,000 crore in the economic yr 2021-22 to meet its capex, desire prices, deferred spectrum legal responsibility and section payment of AGR dues.

The firm is envisioned to generate significantly less than 50 percent of the running revenue in FY22 [Rs 13,200 crore].

This will demand the organization to raise its regular earnings for every consumer (ARPU) by 53% to Rs 190 from Rs 121 at present. Offered the increased share of the entry-level and rural foundation, Vodafone has the cheapest ARPU in the sector.

Angel Broking believes that amplified subscriber churn without having fixation of floor tariffs and no main aid from the Supreme Courtroom on the AGR matter will make it hard for Vodafone Thought to survive in the marketplace.

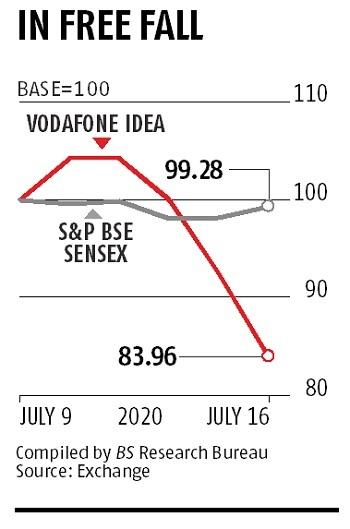

The stock of Vodafone Thought has slipped by 16% more than the previous two trading periods.

(By arrangement with Business enterprise Common)