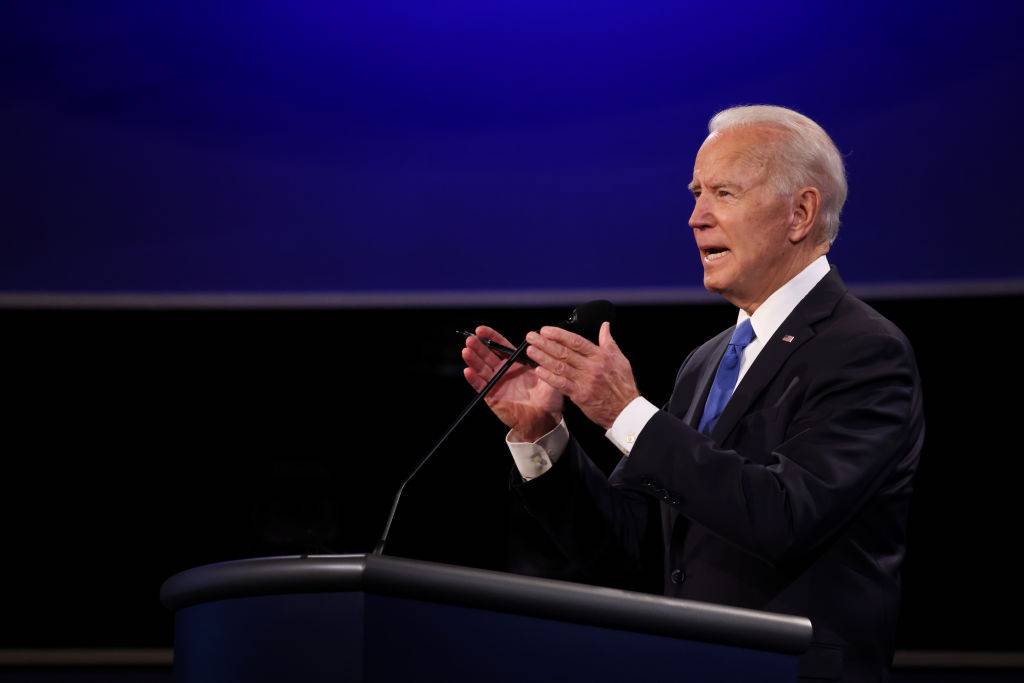

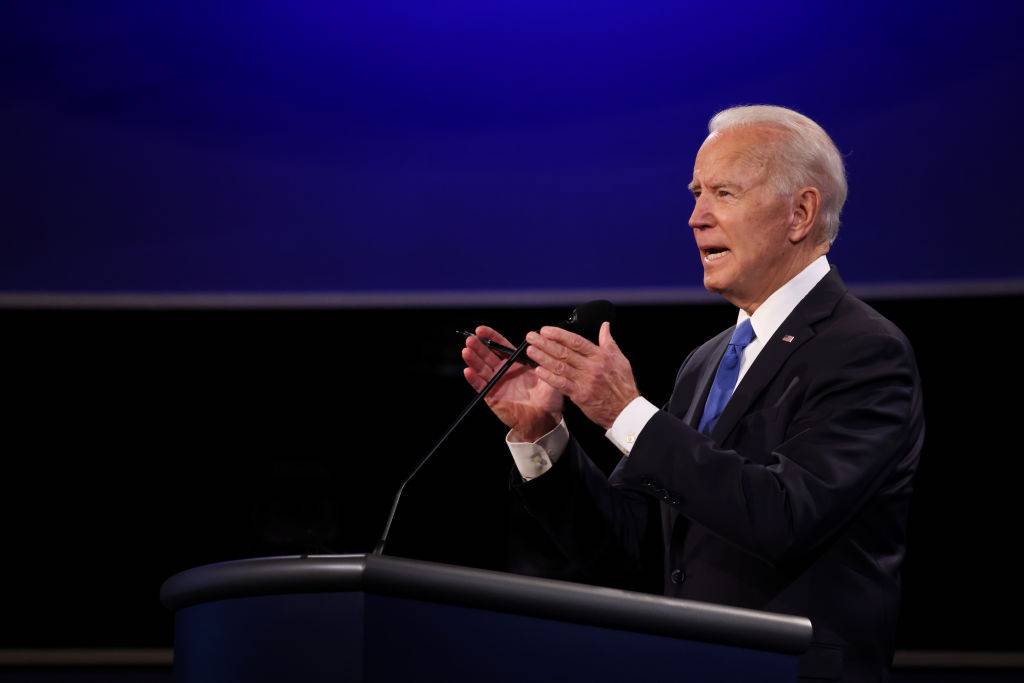

(Justin Sullivan / Getty Images)

Recent elections in the United States have placed Democrats under executive and congressional control, though with a tight margin in the Senate. Democratic dominance was last seen when Barack Obama was elected president in 2008, taking on both houses in Congress, with an even greater Democratic majority.

Very little difference in Congress and majority of increasing polarization in American politics Limited advancement of democratic political agenda including expanding the role of government in the state. This is particularly the case for issues that require bipartisan support (or, at least, the votes of more liberal Democrats).

Given the dynamics of US policy, there is widespread hope in markets that the government Biden focuses on doing as much as possible in the first two years of managementBefore the mid-term parliamentary elections.

Certainly, the epidemic has strengthened the government’s role in providing assistance to address the severe impacts of Kovid-19 from its health and economic point of view. The nature of the origin of this crisis and the absence of financial collapse that characterizes the global financial crisis – an important source of the crisis moral hazard [risco moral, em português, conceito que diz que agentes tomaram risco excessivo no mercado porque sabiam que seriam socorridos diante de eventuais prejuízos] This led to excessive financial risk – facilitating rapid and macroeconomic policy response, particularly in the fiscal sector.

In the case of fiscal measures, with public support for the approval of direct transfer of resources to citizens and business support packages (which were also seen in previous management), the first recovery package quickly passed, although without the support of Republicans . The next fiscal package, focusing on infrastructure, is also seen to accelerate economic recovery, particularly in terms of job creation, and as a way to increase long-term productivity (especially in areas that are Were exposed during the epidemic, such as Wi-Fi coverage and health infrastructure).

However, advances in other aspects of fiscal policy, such as Increase in tax revenue To compensate for the fiscal deficit and the increase in public debt, resulting in pandemic-fighting packages and infrastructure spending, Congress faces more difficulties, Including the necessary support of liberal Democrats.

In addition, the effectiveness of tax proposals, such as the increase in corporate taxes, requires a high level of coordination with other countries, acknowledged Janet Yellen, secretary of the United States National Treasury, therefore, it is not an easy task.

If this type of initiative prevails in developed economies, the opportunity opens up for emerging economies, such as Brazil., Follow suit, as many of them have also observed that their financial situation is further strained as a result of the crisis caused by Kovid.

Blackrock’s development approach can be found for G7 economies including the US The painter does the Macron Blackrock Investment Institute [que prevê avanço de 4,7% para os Estados Unidos, contra 5,44% do consenso de mercado]. The expected growth for 2021 is in line with an economic recovery in the US economy, which affects fuel and consumption and employment generation by significant fiscal stimulus and is also affected by additional liquidity conditions provided by the Federal Reserve, the US central bank .

The US economy is expected to return to a growth rate of 2% to 3% due to winds of recovery. However, the increase in productivity that may be generated by the epidemic (for example, the benefits of remote work and the efficiency of e-retail platforms), as well as the improvement of infrastructure, may shift potential growth to the upper limits of that range .

The economic recovery of the United States and China (already commencing in the second half of 2020), and the final recovery in the rest of the world (with respect to most countries in Europe expected in the second half of 2021; and only the highest in 2022 For) countries). Emerging non-Asian countries) jCommodity prices were impacted. This will be an important boost for many regions in BrazilHowever, the segments that depend most on domestic demand will be able to recover only next year.