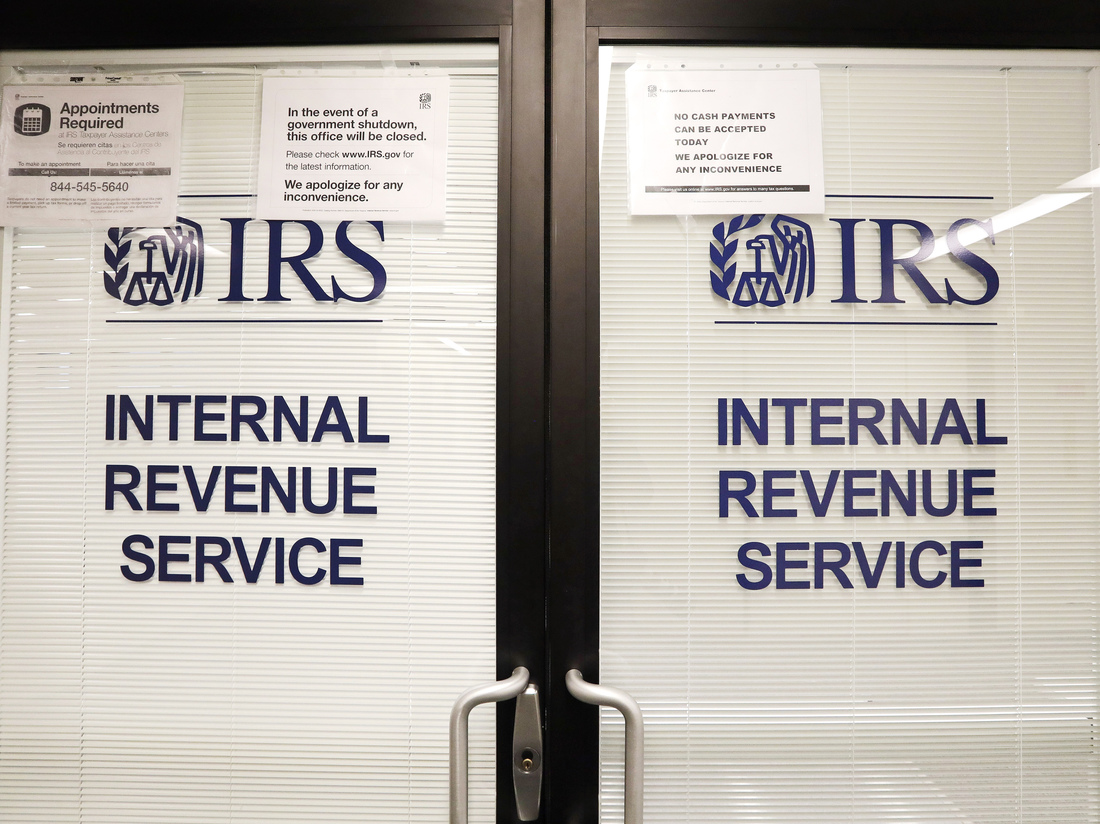

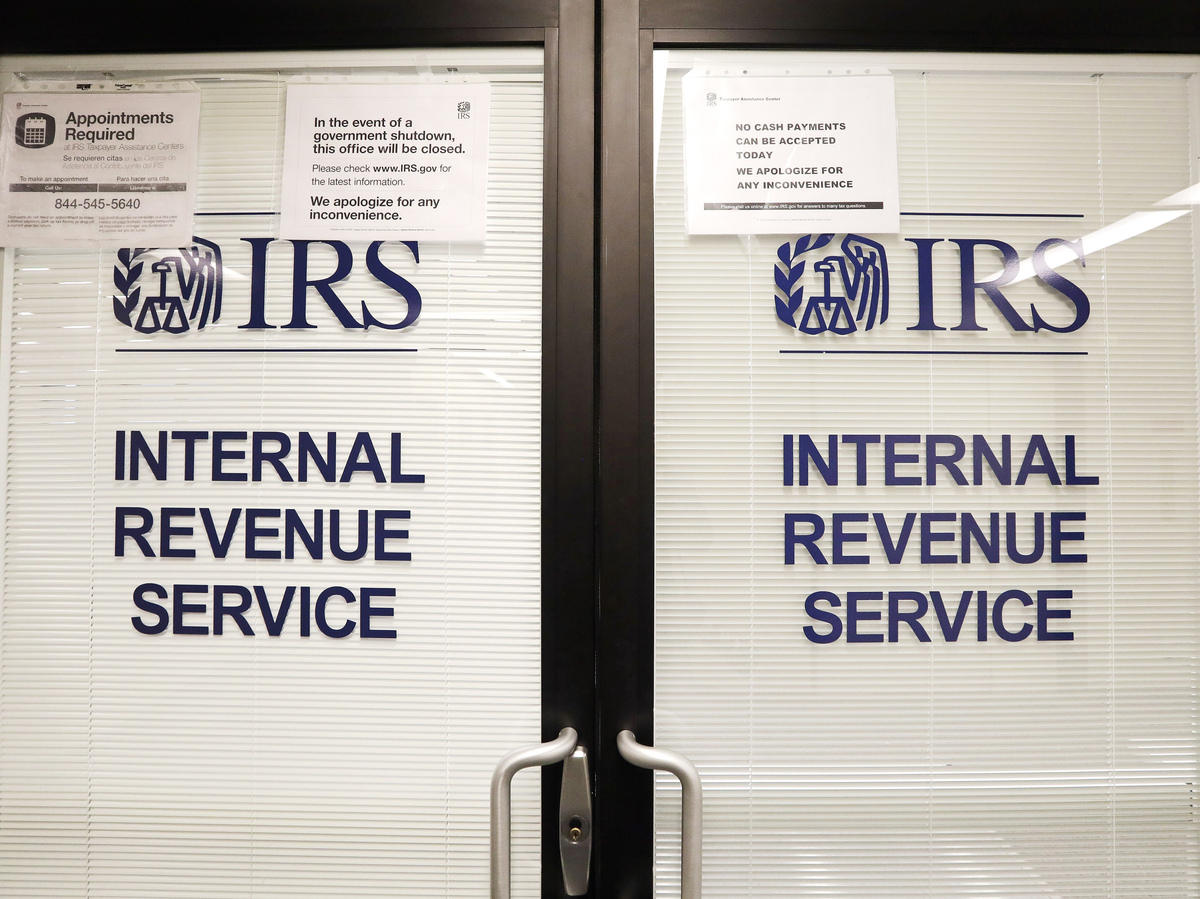

Businesses are supposed to halt withholding the payroll tax on Sept. 1. But providers need steerage from the IRS on just who is qualified to have their taxes suspended and how to retain monitor so individuals taxes can at some point be repaid.

Elaine Thompson/AP

cover caption

toggle caption

Elaine Thompson/AP

Businesses are supposed to halt withholding the payroll tax on Sept. 1. But providers will need steering from the IRS on precisely who is suitable to have their taxes suspended and how to hold observe so all those taxes can ultimately be repaid.

Elaine Thompson/AP

President Trump needs to give a $100 billion raise to the U.S. economic climate by hitting the “pause” button on workers’ payroll taxes.

That would go away more revenue in people’s paychecks. But the go — which Trump purchased above the weekend — is only momentary. And that could make complications down the road for personnel, employers and the Social Stability system.

Trump announced the payroll tax suspension on Saturday as component of a series of moves made to sidestep Congress following talks on a far more comprehensive invoice to offer coronavirus relief broke down. He directed the Treasury Office to quit gathering the 6.2% payroll tax from workers making up to $104,000 a 12 months. The shift is supposed to consider effect up coming thirty day period.

“This will suggest even bigger paychecks for performing family members as we race to make a vaccine,” Trump explained to reporters assembled at his golf club in Bedminster, N.J.

Critics say this distinct aid evaluate is misguided considering the fact that it rewards only folks who are fortunate adequate to have a task still. What is additional, mainly because the tax aid is only short-term, employees are expected to repay the taxes following year.

“What superior does that do people if they just get a temporary payroll tax reduce and have to place that somewhere to save it to repay the funds in a balloon payment a few of months from now?” requested Maya MacGuineas, president of the Committee for a Dependable Federal Finances. “Which is actually carried out quite tiny to strengthen the economic climate.”

Trump insists his goal, if he’s reelected, is to reduce the payroll tax for great.

“If I’m victorious on Nov. 3, I approach to forgive these taxes and make long-lasting cuts to the payroll tax,” Trump stated. “I am going to make them all long term.”

But although the president can delay the assortment of taxes, only Congress can eradicate them entirely. There’s no promise lawmakers would do so. And if they did, that would be a critical blow to Social Security, which the delayed payroll taxes pay for.

“Social Safety is by now struggling with enormous pressures in phrases of the funds,” MacGuineas reported. “Getting rid of the earnings resource that cash the system would make the finances of it significantly, considerably worse.”

White Household economic adviser Larry Kudlow argued that the administration would simply just borrow revenue if vital to make up for any shortfall in Social Security.

Still, the payroll tax suspension seemed to have little aid outside the White Dwelling and a smaller circle of presidential advisers. It never gained a lot traction in Congress. And the U.S. Chamber of Commerce built crystal clear it really is not a little something its users were being inquiring for.

“The people today who enjoy the payroll tax minimize are the American individuals,” reported conservative pundit Stephen Moore — an adviser to Trump’s campaign who was briefly floated as a nominee for the Federal Reserve.

Moore, who co-started the anti-tax Club for Expansion, has been just one of the most dogged advocates for payroll tax aid.

“Almost all Americans who are doing the job are going to see a wonderful strengthen in their paychecks,” he said of the deferred tax collection. “That places money in the financial system and incentivizes people to operate. I believe that is a quite optimistic result.”

Employers are supposed to prevent withholding the payroll tax on Sept. 1, but for quite a few it won’t be that simple. Corporations want advice from the IRS on just who is suitable to have their taxes suspended and how to maintain monitor so those people taxes can sooner or later be repaid.

“It really is heading to be a combined bag of employers,” claimed Pete Isberg, vice president of authorities relations for ADP, which handles payroll for hundreds of thousands of companies. He claimed while some providers will be equipped to regulate their computers immediately to prevent withholding payroll taxes, “some will be ready to do it in October or November. And some may possibly just hardly ever do it.”

Isberg said providers also want some reassurance that they is not going to be on the hook for their workers’ taxes, if Congress doesn’t forgive the monthly bill. They’ll also have to test to demonstrate to workforce why just take-household spend is or is not going up in September, and how that could be reversed early next yr.