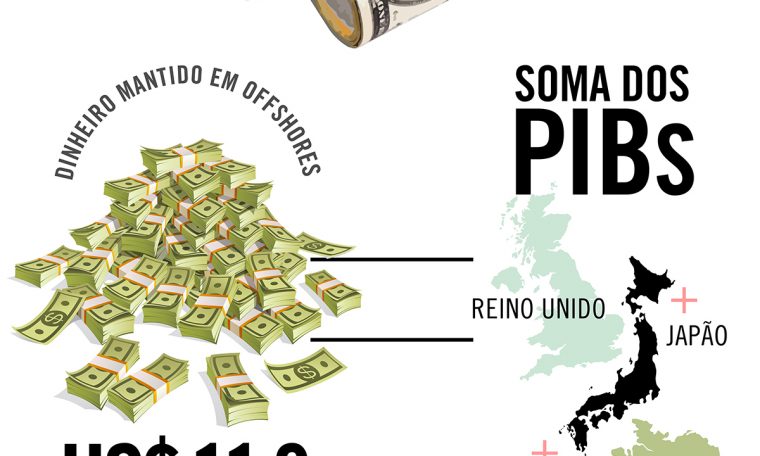

DAnd according to a study by the Organization for Economic Co-operation and Development (OECD), at least $11.3 trillion is kept “offshore,” that is, outside the country where company owners live. This value is equal to the combined GDP of Japan, Germany and the United Kingdom. These countries are among the five richest countries in the world and GDP represents the sum of all final goods and services produced by them.

Keeping a company out of the country is not illegal. The problem is that these ventures can be used for tax evasion or to cover up illegal businesses. Generally, tax havens offer benefits such as privacy, low taxation and easy accountability. Therefore, it is not possible to know how much of these 11 trillion is linked to tax evasion and other crimes.

The Association of Investigative Journalists opens the offshore Pandora’s Box. Millions of documents leaked from government offices around the world revealed the financial secrets of more than 330 high-level politicians and civil servants, including world leaders, ministers and ambassadors from 91 countries. These include Economy Minister Paulo Guedes and Central Bank President Roberto Campos Neto.