B3 announced that starting this Monday (21) it will start talks on 16 new bdr of companies listed on stock exchanges (Brazil’s depository receipts) London (London Stock Exchange), Canada (Toronto Stock Exchange) and Amsterdam (Euronext).

From now on, companies prefer heinekenThe London Stock Exchange Group and Thomson Reuters Corporation are on the list.

In a press release, Marcos Scheistimas, superintendent of equities, interest and currency products at B3, highlighted the importance of the measure.

“With new products, the possibilities of diversifying investors’ portfolios increase, be it across currencies, sectors or regions,” he said.

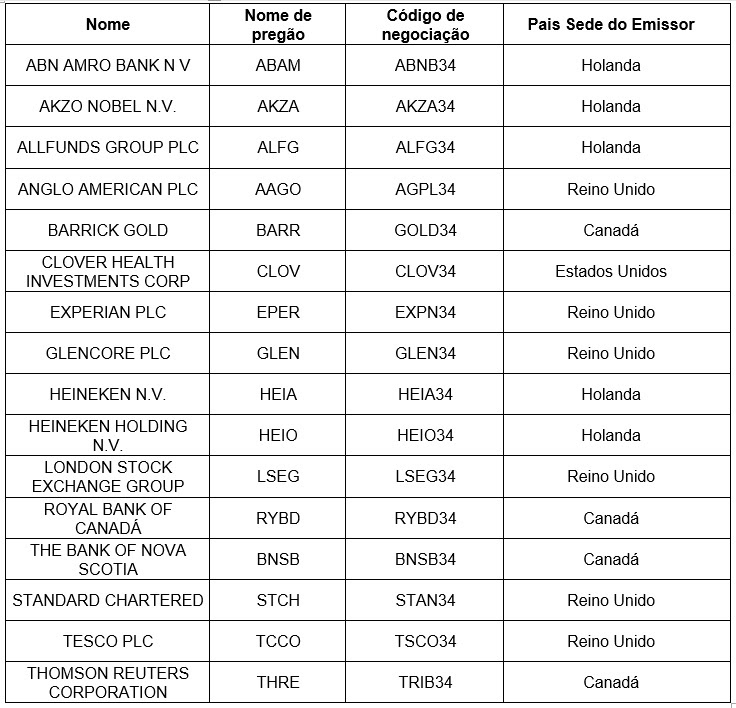

Check out the list of new roles below:

BDR on Exchange

B3 began trading BDR for small investors on October 22, 2020. Previously, only those considered eligible – that is, those with at least BRL 1 million in investments – had access to the papers.

Since then, any investor on the Brazilian stock exchange has access to this type of investment, which is a kind of “mirror” of foreign shares of companies such as Apple ,AAPL34, Netflix ,nflx34, Alibaba ,Baba 34, Disney ,DISB34, Tesla ,TSLA34) and others.

Today, there are already a total of 827 BDRs listed. Most are US assets with 671, followed by the UK with 28 and Canada with 21.

The rest is divided between the countries of Latin America, Europe And Asia,