Graphic copyright

Graphic copyright

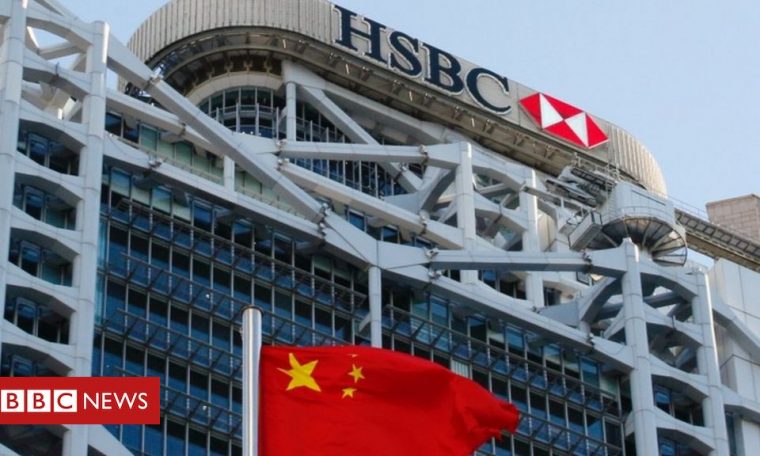

Reuters

HSBC’s revenue for the 1st fifty percent of this calendar year have plunged 65% as it battles the coronavirus downturn.

The UK’s most important lender posted pre-tax income of $4.3bn, compared to $12.4bn for the exact same time period previous year.

The slide was much greater than analysts had forecast and signifies just how tough HSBC has been strike by the effects of the pandemic.

Though HSBC is headquartered in London, much more than 50 percent of its profits come from the Asian financial hub of Hong Kong.

The bank is dealing with a range of difficulties, not just the economic downturn brought about by the coronavirus.

It is at the moment embroiled in a political struggle around its guidance of China’s nationwide security law in Hong Kong even though pushing forward with a major restructuring of its world banking operations.

“We will facial area any political challenges that crop up with a emphasis on the long-term needs of our buyers and the very best passions of our investors,” HSBC’s team main chief govt Noel Quinn claimed on Monday.

“Latest tensions concerning China and the US inevitably build complicated predicaments for an organisation with HSBC’s footprint. However, the have to have for a bank capable of bridging the economies of east and west is acute, and we are effectively placed to fulfil this job.”

Job cuts

In June, the UK’s greatest bank, said it will force forward with its strategy to minimize 35,000 employment from a global workforce of 235,000 as component of a key restructuring announced in February.

HSBC chairman Mark Tucker is overseeing the programme to shrink the bank’s functions in Europe and the US.

The layoffs experienced initially been place on keep during the coronavirus outbreak but are now again on the agenda.

HSBC has formerly said it could wind down or offer its US retail banking operations which could involve shrinking its 224-potent US branch network by about 30%.

Caught in crosshairs

HSBC, alongside with rival banking team Normal Chartered, came less than fire for coming out in guidance of China’s controversial national protection regulation for Hong Kong.

Also in June, US Secretary of Condition Mike Pompeo and Uk politicians criticised HSBC for supporting China’s new legislation, which means folks encounter prosecution for speaking out from Beijing.

Mr Pompeo reported the Chinese Communist Party’s (CCP) “browbeating” of HSBC “need to provide as a cautionary tale”.

Equally HSBC and Standard Chartered have their headquarters in London but earn a significant part of their revenue in Asia, with Hong Kong serving as a hub for the region.

Previous 7 days, Typical Chartered also launched its 50 percent-annually benefits and restated its motivation to Hong Kong.

In a statement, Normal Chartered’s group chairman José Viñals dealt with the intercontinental tensions about China’s guidelines in Hong Kong:

“We are confident that a lot more collaboration – not fewer – is the most effective way to discover a sustainable equilibrium in these complex predicaments, but we do not assume an uncomplicated or swift resolution.

“We do think, however, that Hong Kong will continue on to enjoy a essential position as an worldwide financial hub and we are fully fully commited to contributing to its continued success,” he extra.