10:02

Sunak defends childcare support

Q: Why was there no mention of childcare in your summer statement, given women have been badly affected by the lockdown?

Sunak says many sectors didn’t get a mention in his 22 minute statement.

He agrees that women are disproportionately likely to work in hospitality, so they should benefit from the ‘eat out to help out’ scheme.

And on childcare, he says nurseries received a 12-month holiday on business rates, and childcare providers are getting all their government funding even if they’re closed.

That equates to 50% of revenue, he says.

09:54

Labour MP Angela Eagle asks Rishi Sunak about concerns that his jobs retention scheme, and the ‘eat out to help out’ offer, are badly targeted – and was challenged by the head of HMRC as being bad value.

Rishi Sunak replies that he firmly believes the £1,000 bonus for taking back furloughed staff will make a difference, particularly for lower-paid workers.

I’m determined to do what I can to protect as many jobs as possible, he insists.

Q: But wouldn’t a targeted scheme be more efficient? Why not focus on the sectors that are most struggling?

Sunak says his original furlough scheme had faced similar criticism when launched, but is now recognised as successful.

It’s not practical or feasible for the Treasury to assess companies across the UK, and decide which need help, the chancellor replies. Who do you think shouldn’t get help?

Eagle doesn’t let the chancellor turn the tables, but instead cites aerospace as a sector that deserves particular support (Airbus, for example, are cutting 1,700 jobs in the UK).

09:47

Q: What’s the chancellor’s plan to help the hundreds of thousands of small firms who will be indebted once the Covid-19 crisis has ended?

Rishi Sunak argues that this isn’t a desperate debt crisis – as corporate debt levels were low by historic standards as we entered the crisis.

He’s also not persuaded that the government should take equity stakes in hundreds of thousands of small firms, but he’s open to ideas to help.

09:40

Sunak: Strong sustainable public finances matter

The Chancellor of the Exchequer, Rishi Sunak, is appearing before parliament’s Treasury committee now.

You should be able to see a live feed at the top of his blog.

Mel Stride MP, chair of the committee, begins asks Sunak whether he’ll need to raise taxes to address the UK deficit, which is likely to exceed £300bn this year due to the cost of the pandemic.

Disappointingly, Sunak declines to comment on future fiscal policy.

He says “strong sustainable public finances are important”. But, the exact shape of the fiscal response must wait for a future budget.

Stride presses him on the Conservative’s manifesto pledge to keep the pensions ‘triple lock’. Does Sunak agree with prime minister Boris Johnson, who said in late May that he’d keep his manifesto promises?

Sunak replies that he always agrees with the PM… but he won’t comment on future tax policy now.

Richard Partington

(@RJPartington)Treasury committee chair Mel Stride questions Rishi Sunak about Conservative party manifesto commitments not to raise tax. Sunak refuses to be drawn. But is Tory manifesto the most important question to ask following last week’s summer economic update and in light of Covid?

09:28

Just in: US industrial output has jumped as America’s factories got back to work last month.

Industrial production across the States rose by 5.4% month-on-month in June, more than expected. That’s up from a 1.4% gain in May, as the lockdown eased.

The narrower gauge of manufacturing output jumped by over 7%, in another sign that the economy is turning around.

However, today’s data also shows industrial output is still 10.8 % lower than in June 2019.

JimMacKayOnAir

(@JimMacKayOnAir)WASHINGTON (AP) – US industrial production surges 5.4% in June, second straight monthly gain; factory output up 7.2%.

jeroen blokland

(@jsblokland)BREAKING! US Industrial production rose 5.4% in June, more than expected. pic.twitter.com/0XN4suwBFT

08:59

Online grocery group Ocado is one of the top risers in London, up 6%.

It’s done well in the lockdown, with sales surging 40% in May. It now has a waiting list of one million customers (!), suggesting the pandemic has significantly accelerated the move towards web deliveries.

08:40

President Trump has tweeted that there’s ‘great news’ on the vaccine front.

He’s not specified which medical trials have caught his eye, but I imagine it’s last night’s update from Moderna.

Moderna’s shares are up 16% in pre-market trading, after reporting its coronavirus vaccine candidate produced a “robust” immune-system response in all 45 patients in a trial.

Donald J. Trump

(@realDonaldTrump)Great News on Vaccines!

08:09

Goldman Sachs is also putting aside an extra $1.59bn to cover credit losses, as it anticipates an increase in bad debts during the pandemic.

That’s up from $937m in the January-March, and $214m in Q2 2019, lifting Goldman’s total allowance for credit losses was $4.39 billion.

It says in today’s results that:

The increase compared with the second quarter of 2019 was primarily due to significantly higher provisions related to wholesale loans and, to a lesser extent, consumer loans, reflecting revisions to forecasts of expected deterioration in the broader economic environment.

Mini Macrodesiac

(@MiniMacrodesiac)GOLDMAN SACHS – QTRLY PROVISION FOR CREDIT LOSSES $1.59 BLN, UP 70% VS Q1 2020

Although it’s a sharp increase in loan provisions, it’s also less than some rivals.

Yesterday, JP Morgan took a record $10.5bn in loan loss charges, including $8.9bn for expected bad loans in the future.

07:42

Goldman smashes forecasts

Just in: Goldman Sachs has just beaten market forecasts by reporting that earnings rose in the last quarter despite the pandemic.

Goldman posted diluted earnings per common share (EPS) of $6.26 for the second quarter of 2020, up from $5.81 for the second quarter of 2019 and $3.11 for the first quarter of 2020.

Net revenues in the quarter were 41% higher than a year ago, at $13.30bn – the second best in its history, as the Wall Street bank benefited from the pick-up in the markets since March.

Goldman says economic indicators “generally improved” during the quarter as economies began to reopen and central banks and governments announced stimulus programmes – lifting asset prices.

Investors are impressed – sending Goldman’s shares up 4% in pre-market trading.

Investing.com

(@Investingcom)*GOLDMAN SACHS SHARES JUMP 4% AFTER SECOND QUARTER EARNINGS, REVENUE BLOW PAST EXPECTATIONS$GS pic.twitter.com/FLs6bcKYiq

David Solomon, Goldman’s chairman and CEO, says:

Our strong financial performance across our client franchises demonstrates the inherent benefits of our diversified business model. The turbulence we have seen in recent months only reinforces our commitment to the strategy we outlined earlier this year to investors.

While the economic outlook remains uncertain, I am confident that we will continue to be the firm of choice for clients around the world who are looking to reshape their businesses and rebuild a more resilient economy.”

07:20

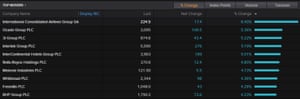

The FTSE 100 is pushing higher, now up 112 points or 1.8% today at 6292 (the highest in seven sessions).

All but 14 of the one hundred blue-chip companies on the index are up today, lifted by ITV’s report of vaccine progress in Oxford, and by Moderna’s encouraging trial results last night.

The FTSE 100 Photograph: Refinitiv

Hospitality firms are rallying, with Intercontinental Hotels and Whitbread (which owns Premier Inns) among the risers. British Airways’ parent company, IAG, is now up 9%, topping the leaderboard.

That highlights optimism that the battered travel sector could recover, if a vaccine comes to market.

The top risers on the FTSE 100 today Photograph: Refinitiv

07:05

A working Covid-19 vaccine would allow economies around the world to rebound, and take advantage of the stimulus programmes announced since the pandemic began.

As Fawad Razaqzada, market analyst at ThinkMarkets, puts it:

“Investors are hopeful that we are getting closer and closer to finding effective treatments for coronavirus and an end to the pandemic, which could then clear the way for a big rebound in economic activity with so much stimulus money already in place by governments and central banks.

06:57

Wall Street is also on track to rally in a few hours.

The Dow Jones industrial average expected to open 1.2% higher (up around 320 points at 26,970).

Craig Erlam, senior market analyst at OANDA Europe, says investors are taking heart from positive vaccine trial news.

Stock markets have been given another lift this morning by another promising vaccine trial, this time from Moderna, as the race to be the first to market intensifies.

It goes without saying that a vaccine will be the gamechanger in the pandemic, the thing that will allow life to return to normal and businesses and households to thrive once again. So it’s hardly surprising that investors get a little excited when the results of these trials emerge, even those in the early stages.

Updated